Embark on a journey through the intricate world of financial planning as we delve into the crucial role of investment horizon. From understanding the significance of investment timelines to exploring tailored strategies, this topic offers a wealth of knowledge for making informed decisions.

As we navigate through the various aspects of investment horizon, we uncover how it influences financial goals, shapes investment strategies, and guides advisors in crafting personalized plans. Join us in unraveling the complexities of financial planning with a focus on investment horizon.

Introduction to Investment Horizon

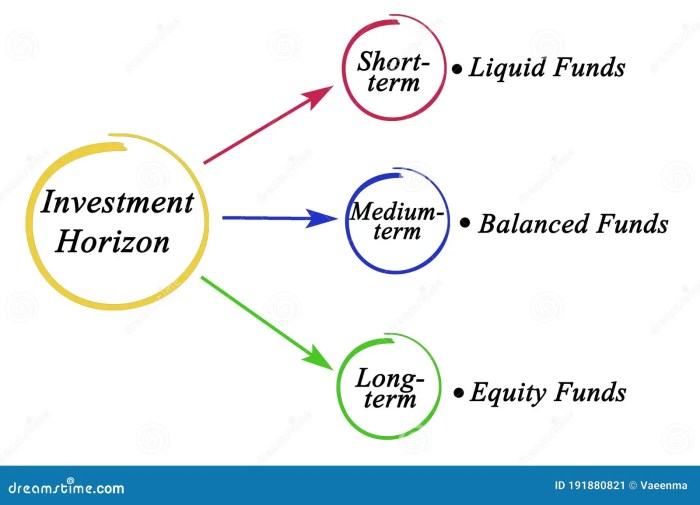

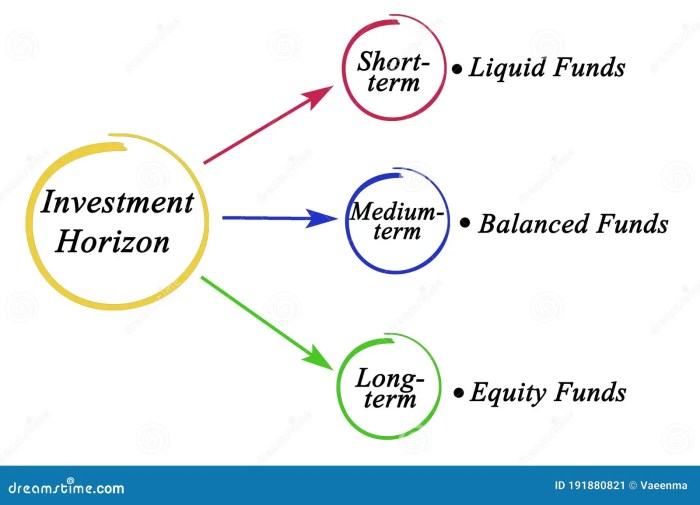

An investment horizon is the length of time an investor expects to hold an investment before needing the funds for a specific financial goal. It is a crucial factor in financial planning as it helps determine the appropriate investment strategy based on the time horizon of the individual or institution.

Considering investment horizon is essential when making financial decisions because it affects the choice of investment vehicles, risk tolerance, and potential returns. Different investment horizons require different approaches to investing to achieve the desired financial goals.

Examples of Investment Horizons

- Short-term: A short-term investment horizon typically ranges from a few months to a year. Examples include emergency funds, upcoming expenses, or short-term goals like purchasing a car or going on vacation.

- Medium-term: A medium-term investment horizon usually spans from one to five years. Examples include saving for a down payment on a house, funding a child’s education, or planning for a major life event like a wedding.

- Long-term: A long-term investment horizon extends beyond five years and is focused on achieving significant financial goals such as retirement savings, building wealth, or creating a legacy for future generations.

Factors Influencing Investment Horizon

Age and Financial Goals Impact:Investment horizon is greatly influenced by factors such as age and financial goals. Younger individuals typically have a longer investment horizon as they have more time to ride out market fluctuations and benefit from compounding returns. On the other hand, older individuals nearing retirement may have a shorter investment horizon and may prioritize capital preservation over growth.Risk Tolerance Role:Risk tolerance also plays a crucial role in determining the suitable investment horizon.

Those with a higher risk tolerance may be willing to invest in assets with longer time horizons that offer potentially higher returns, while individuals with a lower risk tolerance may opt for shorter investment horizons with more conservative investments.Impact of Market Conditions:Market conditions can significantly impact investment horizons. During periods of economic instability or market volatility, investors may choose to adjust their investment horizons to mitigate risks and protect their portfolios.

Conversely, during periods of market growth and stability, investors may extend their investment horizons to capitalize on opportunities for higher returns.

Tailoring Investment Strategies to Investment Horizon

When it comes to financial planning, tailoring investment strategies to match your investment horizon is crucial for achieving your financial goals. Different investment strategies are suitable for varying investment horizons due to the time frame over which you expect to invest your money. Let’s delve into how investment strategies can be aligned with short, medium, and long-term horizons, as well as the importance of diversification based on the investment horizon.

Short-Term Investment Horizon

Short-term investment horizons typically range from a few months to a couple of years. For individuals with a short-term horizon, it is important to prioritize liquidity and capital preservation. Examples of investment instruments that align with a short-term horizon include:

- High-yield savings accounts

- Money market funds

- Short-term bonds

Diversification is still important even for short-term investments to mitigate risks and protect your capital.

Medium-Term Investment Horizon

A medium-term investment horizon usually spans a few years to a decade. Investors with a medium-term horizon can consider a mix of growth and income investments. Examples of investment instruments suitable for a medium-term horizon include:

- Stocks of established companies

- Mutual funds

- Corporate bonds

Diversifying across different asset classes can help balance risk and return for medium-term investments.

Long-Term Investment Horizon

For individuals with a long-term investment horizon, which can be several decades, the focus is on growth and wealth accumulation. Long-term investors can consider more volatile investments with higher return potential. Examples of investment instruments for a long-term horizon include:

- Index funds

- Real estate investments

- Retirement accounts like 401(k) or IRA

Diversification across various industries, regions, and asset classes is crucial for long-term investors to weather market fluctuations and achieve their financial objectives.

Investment Opportunities Across Different Horizons

Investors have the opportunity to explore various investment options based on their desired time horizon. Each horizon – short, medium, or long-term – offers unique opportunities with varying levels of potential returns and risks. Understanding how to capitalize on these opportunities within different horizons is crucial for a well-rounded investment strategy.

Short-Term Investment Opportunities

Short-term investment opportunities typically involve investments with a duration of one year or less. These may include:

- High-yield savings accounts or certificates of deposit

- Money market funds

- Short-term bonds or bond funds

Medium-Term Investment Opportunities

Investors with a medium-term horizon, usually ranging from one to five years, can consider the following investment options:

- Corporate bonds

- Real estate investment trusts (REITs)

- Diversified mutual funds

Long-Term Investment Opportunities

For investors looking at long-term horizons of five years or more, there are opportunities for growth and compounding. Some long-term investment options include:

- Stocks of established companies

- Index funds or exchange-traded funds (ETFs)

- Retirement accounts like 401(k) or IRA

Role of Investment Advisors in Determining Investment Horizon

Investment advisors play a crucial role in assessing clients’ investment horizons and tailoring financial plans accordingly. By understanding the client’s time frame, risk tolerance, and financial goals, advisors can provide personalized guidance that aligns with the client’s specific needs.

Assessing Clients’ Investment Horizons

- Investment advisors evaluate clients’ investment horizons by considering factors such as age, financial objectives, and risk tolerance.

- They may use tools like risk assessment questionnaires and in-depth discussions to gauge how long the client intends to hold investments before needing to access funds.

- Through this assessment, advisors can determine whether the client’s investment horizon is short-term, medium-term, or long-term.

Significance of Aligning Investment Advice with the Client’s Horizon

- Aligning investment advice with the client’s horizon is crucial for maximizing returns and achieving financial goals.

- Short-term investors may focus on more stable investments with lower risk, while long-term investors can afford to take on more risk for potentially higher returns.

- By tailoring investment strategies to the client’s horizon, advisors can help clients stay on track towards their financial objectives.

Customizing Financial Plans Based on Different Horizons

- For clients with short-term horizons, investment advisors may recommend conservative investment options like money market accounts or short-term bonds.

- Medium-term investors may be advised to diversify their portfolios with a mix of stocks, bonds, and other assets to balance risk and return.

- Long-term investors can benefit from a more aggressive approach, including a higher allocation to equities for long-term growth potential.

Impact of Investment Horizon on Financial Goals

Investment horizon plays a crucial role in determining the success of achieving financial goals. A well-defined investment horizon helps investors establish a clear timeline for their objectives and allows them to align their investment strategies accordingly.

Relationship between Investment Horizon and Compounding Returns

One of the key benefits of having a longer investment horizon is the power of compounding returns. Compounding allows investors to earn returns not just on their initial investment, but also on the returns generated over time. The longer the investment horizon, the greater the potential for compounding to work its magic and accelerate wealth accumulation.

Adjusting Financial Plans Based on Changing Investment Horizons

As life circumstances change, so do investment horizons. It is essential for investors to regularly review and adjust their financial plans based on any changes in their investment horizon. For example, if an individual’s investment horizon shortens due to nearing retirement, they may need to shift towards more conservative investment options to protect their capital.

In conclusion, the role of investment horizon in financial planning cannot be overstated. By aligning investment strategies with specific timeframes and goals, individuals can pave the way for financial success and growth. Let this discussion serve as a guiding light in your journey towards a secure financial future.

Essential FAQs

How does age impact one’s investment horizon?

Age influences investment horizon by determining the timeframe available for investments to grow and mature. Younger individuals may have a longer horizon to ride out market fluctuations, while older individuals may prefer shorter-term investments.

Why is diversification important based on the investment horizon?

Diversification helps manage risk by spreading investments across different assets and sectors. Tailoring diversification strategies to the investment horizon ensures a balanced portfolio that can weather market changes.

Can investment advisors customize financial plans for different horizons?

Yes, investment advisors can tailor financial plans to suit varying investment horizons based on clients’ goals, risk tolerance, and market conditions. Customized plans maximize returns and align with individual financial objectives.