Embark on a journey through the intricate world of Hedge Fund Investment Strategy, where the pursuit of optimal returns meets the art of strategic decision-making. Unravel the complexities and nuances of this financial realm as we delve into the heart of investment strategies that drive success and growth.

Introduction to Hedge Fund Investment Strategy

A hedge fund is a type of investment fund that pools capital from accredited individuals or institutional investors and invests in a variety of assets. The primary purpose of a hedge fund is to generate high returns for its investors while managing the associated risks.

When it comes to hedge fund investment strategy, it refers to the set of rules, guidelines, and principles that guide the fund manager in making investment decisions. This strategy Artikels how the fund will allocate capital, manage risk, and achieve its financial objectives.

Importance of a Well-Defined Investment Strategy

Having a well-defined investment strategy is crucial for hedge funds for several reasons:

- It helps to align the fund’s investment decisions with its overall objectives and risk tolerance.

- A clear investment strategy provides transparency to investors, helping them understand how their money is being managed.

- By having a structured approach to investing, hedge funds can effectively manage risk and optimize returns.

- Having a defined strategy also allows the fund manager to stay disciplined and avoid emotional decision-making.

Types of Hedge Fund Investment Strategies

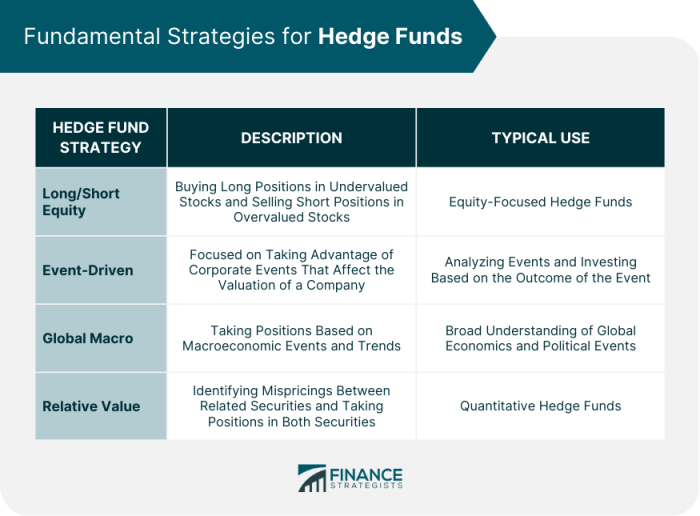

In the world of hedge funds, there are various investment strategies that fund managers employ to generate returns for their investors. Each strategy comes with its own set of risk-return characteristics, objectives, and methods. Let’s explore some common types of hedge fund investment strategies:

Long/Short Equity

Long/Short Equity is one of the most popular hedge fund strategies. Fund managers take long positions in stocks they believe will increase in value (long) and short positions in stocks they believe will decrease in value (short). This strategy aims to profit from both rising and falling stock prices, providing a more balanced return profile. However, it is important to note that it involves risks related to market movements and stock selection.

Global Macro

Global Macro hedge funds take advantage of broad market trends and economic events on a global scale. Fund managers make bets on currencies, interest rates, commodities, and other macroeconomic factors. This strategy can provide diversification benefits but also carries risks associated with geopolitical events, economic indicators, and currency movements.

Event-Driven

Event-Driven hedge funds focus on specific corporate events such as mergers, acquisitions, bankruptcies, or restructurings. Fund managers seek to profit from the price movements that occur as a result of these events. While this strategy can offer high potential returns, it also involves event-specific risks and timing uncertainties.

Relative Value

Relative Value hedge funds aim to capitalize on pricing inefficiencies in the market. Fund managers identify mispriced securities or assets and make trades to exploit these discrepancies. This strategy involves less directional risk compared to other strategies but requires expertise in valuation and risk management.

Arbitrage

Arbitrage strategies involve simultaneously buying and selling related securities to profit from temporary price discrepancies. Fund managers seek to exploit inefficiencies in the market by taking advantage of price divergences in different markets or instruments. While arbitrage opportunities may offer low-risk returns, they require sophisticated trading systems and quick execution.Overall, each hedge fund investment strategy offers a unique approach to generating returns and managing risks.

Investors should carefully consider the objectives, risk-return profiles, and methods of each strategy before making investment decisions.

Factors Influencing Hedge Fund Investment Strategy

Factors influencing hedge fund investment strategy play a crucial role in shaping the decisions made by fund managers. These factors include market conditions, regulatory environment, investor expectations, risk management, and diversification.

Market Conditions

Market conditions have a significant impact on hedge fund investment strategies. The performance of various asset classes, interest rates, inflation rates, and overall economic conditions influence the allocation of assets within a hedge fund. Fund managers closely monitor market trends and adjust their strategies accordingly to capitalize on opportunities and mitigate risks.

Regulatory Environment

The regulatory environment in which hedge funds operate also influences investment strategies. Changes in regulations, compliance requirements, and reporting standards can impact the way funds are managed. Fund managers must stay abreast of regulatory developments to ensure that their strategies align with legal requirements and industry best practices.

Investor Expectations

Investor expectations play a crucial role in shaping hedge fund investment strategies. Fund managers must consider the risk tolerance, return objectives, and investment preferences of their investors when designing and implementing strategies. Meeting investor expectations is essential for maintaining and attracting capital to the fund.

Risk Management and Diversification

Risk management and diversification are fundamental aspects of hedge fund investment strategies. Effective risk management involves identifying, assessing, and mitigating risks to protect the fund’s capital and generate positive returns. Diversification across asset classes, geographies, and investment strategies helps spread risk and enhance the overall risk-adjusted returns of the fund.

Performance Evaluation of Hedge Fund Investment Strategies

Performance evaluation of hedge fund investment strategies is crucial for investors to assess the effectiveness and success of their investments. Various performance metrics are used to evaluate hedge fund strategies, including the Sharpe ratio, alpha, and beta.

Sharpe Ratio

The Sharpe ratio measures the risk-adjusted return of an investment strategy. It calculates the excess return generated by the strategy compared to a risk-free rate, divided by the standard deviation of the strategy’s returns. A higher Sharpe ratio indicates a better risk-adjusted performance.

Alpha

Alpha measures the excess return of an investment strategy compared to its benchmark index. It indicates the strategy’s ability to outperform the market. Positive alpha suggests that the strategy has generated returns higher than expected based on its risk profile.

Beta

Beta measures the sensitivity of an investment strategy’s returns to market movements. A beta of 1 indicates that the strategy moves in line with the market, while a beta greater than 1 suggests higher volatility compared to the market. Lower beta indicates lower volatility.Challenges associated with measuring the performance of hedge fund investment strategies include the lack of transparency in hedge fund operations, the use of complex financial instruments, and the difficulty in accurately assessing risk-adjusted returns.Examples of successful hedge fund strategies and their performance over time include the Long-Term Capital Management (LTCM) strategy that initially achieved significant returns but later faced a catastrophic collapse due to excessive leverage and market volatility.

Another example is the trend-following strategy employed by managed futures funds, which have demonstrated consistent returns over the long term.

Investment Advice and Strategies

When it comes to hedge fund investments, the role of investment advisors is crucial in guiding clients towards making informed decisions. These professionals provide personalized advice tailored to individual client needs, risk tolerance, and financial goals.

Role of Investment Advisors

Investment advisors play a key role in analyzing market trends, assessing risk factors, and identifying suitable hedge fund investment opportunities for their clients. They act as trusted experts who guide investors through the complex landscape of hedge fund strategies.

Personalized Strategies

- Investment advisors customize strategies based on each client’s risk tolerance level. They take into account factors such as age, income, investment objectives, and time horizon to create a tailored approach.

- By understanding the unique financial goals of their clients, investment advisors can recommend hedge fund strategies that align with long-term objectives, whether it be wealth preservation, capital growth, or risk mitigation.

Importance of Personalized Advice

Personalized investment advice is essential in the context of hedge fund investments because it helps clients navigate the complexities of the market with confidence. By having a dedicated advisor who understands their individual circumstances, investors can make well-informed decisions that are in line with their financial aspirations.

Investment Banking and Hedge Fund Strategies

Investment banking plays a crucial role in supporting hedge funds with their investment strategies. By providing a range of financial services and expertise, investment bankers help hedge funds navigate complex financial transactions and enhance their overall performance.

Relationship between Investment Banking Services and Hedge Fund Investment Strategies

Investment banks offer a wide array of services to hedge funds, including capital raising, mergers and acquisitions, restructuring, and risk management. These services enable hedge funds to access capital, identify investment opportunities, and manage their portfolios effectively. Investment bankers act as strategic advisors, helping hedge funds make informed decisions to optimize their investment strategies.

Assistance of Investment Bankers in Complex Financial Transactions

Investment bankers assist hedge funds in executing complex financial transactions such as leveraged buyouts, initial public offerings, and debt offerings. They provide expertise in structuring deals, negotiating terms, and navigating regulatory requirements. By leveraging their financial acumen and industry knowledge, investment bankers help hedge funds execute transactions efficiently and maximize value creation.

Impact of Investment Banking Activities on Hedge Fund Strategy Performance

The involvement of investment bankers in hedge fund activities can have a significant impact on the overall performance of hedge fund strategies. By providing access to capital markets, facilitating strategic transactions, and offering valuable insights, investment bankers contribute to improving the risk-adjusted returns of hedge fund portfolios. The collaboration between investment bankers and hedge funds enhances the competitiveness and sustainability of hedge fund investment strategies in a dynamic market environment.

Investment Horizon and Strategic Planning

Investment horizon refers to the length of time an investor expects to hold an investment before selling it. It plays a crucial role in developing hedge fund investment strategies as it determines the level of risk that can be taken and the potential return that can be achieved.

Long-term vs. Short-term Investment Strategies

- Long-term investment strategies in the hedge fund industry typically involve holding investments for several years, aiming for steady growth over time. These strategies focus on fundamental analysis and value investing.

- Short-term investment strategies, on the other hand, involve buying and selling securities within a short period, often taking advantage of market inefficiencies or short-term price movements. These strategies may include event-driven or macroeconomic trading.

Investment Opportunities in Hedge Fund Strategies

Investing in hedge funds offers a variety of opportunities for investors to diversify their portfolios and potentially earn high returns. Emerging trends and advancements in technology have opened up new avenues for hedge fund investments. However, it is crucial to carefully analyze the risks and rewards associated with exploring these opportunities.

Market Trends and Technological Advancements

- Market trends such as globalization, digitalization, and regulatory changes present new opportunities for hedge fund strategies.

- Technological advancements, including artificial intelligence, big data analytics, and machine learning, enable hedge funds to make more informed investment decisions.

- Incorporating alternative data sources and quantitative models can provide a competitive edge in identifying profitable investment opportunities.

Potential Risks and Rewards

- Exploring new investment opportunities in hedge funds can lead to higher returns but also carries increased risks due to the complexity of these strategies.

- Risk management is crucial when venturing into new areas, as market volatility and unforeseen events can impact the performance of hedge fund investments.

- Investors must conduct thorough due diligence and consider their risk tolerance before capitalizing on emerging opportunities in hedge fund strategies.

In conclusion, Hedge Fund Investment Strategy emerges as a dynamic field where calculated risks, meticulous planning, and insightful decision-making converge to pave the way for lucrative opportunities and sustainable growth. Dive into this realm armed with knowledge and foresight to navigate the ever-evolving landscape of investment strategies with confidence and precision.

FAQ Explained

What are the key factors that influence Hedge Fund Investment Strategy?

The design and implementation of hedge fund strategies are influenced by factors such as market conditions, regulatory environment, and investor expectations.

How are performance metrics used to evaluate Hedge Fund Investment Strategies?

Performance metrics like Sharpe ratio, alpha, and beta are commonly used to assess the effectiveness and success of hedge fund strategies.

What role do investment advisors play in guiding clients on Hedge Fund Investment Strategies?

Investment advisors assist clients by tailoring strategies based on risk tolerance and financial goals, offering personalized advice to enhance investment decisions.

How do different investment horizons impact the choice of strategies in Hedge Funds?

Different investment horizons play a crucial role in determining whether long-term or short-term strategies are more suitable for hedge funds based on their objectives and goals.

What are some emerging investment opportunities within Hedge Fund Strategies?

Emerging investment opportunities within hedge fund strategies are often shaped by market trends and technological advancements, offering potential risks and rewards for investors to explore.