Embark on a journey through Alternative Investment Strategies, exploring the world of diversification and success. This introduction sets the stage for a captivating exploration of this intriguing topic.

Dive into the realm of alternative investments and discover the keys to maximizing portfolio growth and stability.

Overview of Alternative Investment Strategies

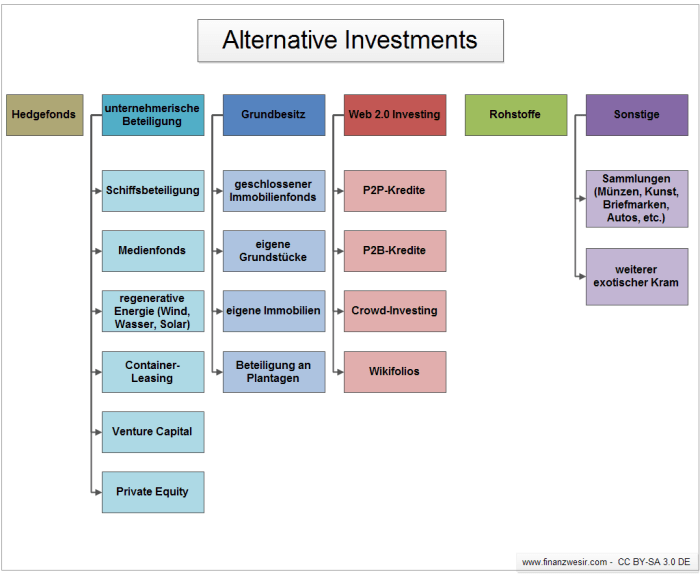

Alternative investment strategies are non-traditional investment options that go beyond stocks, bonds, and cash. These strategies include investments in assets such as real estate, commodities, private equity, hedge funds, and more.

One of the key roles of alternative investment strategies is to diversify investment portfolios. By including alternative investments, investors can reduce risk by spreading their investments across different asset classes that may not move in tandem with traditional investments.

Benefits of Incorporating Alternative Investments

- Diversification: Alternative investments can provide a hedge against market volatility and economic downturns, as they tend to have low correlation with traditional assets.

- Potential for Higher Returns: Some alternative investments have the potential to generate higher returns compared to traditional investments over the long term.

- Access to Unique Opportunities: Alternative investments offer access to unique opportunities that may not be available in traditional markets, such as investing in startups or private companies.

- Inflation Hedge: Certain alternative investments, like real estate and commodities, can serve as a hedge against inflation, helping to preserve purchasing power.

Risks Associated with Alternative Investment Strategies

- Illiquidity: Many alternative investments have lock-up periods and limited liquidity, making it difficult to sell the investment before a specified term.

- Complexity: Alternative investments can be complex and require a deeper level of understanding compared to traditional investments, which may pose challenges for some investors.

- Higher Fees: Alternative investments often come with higher fees and expenses compared to traditional investments, which can eat into returns over time.

- Regulatory Risks: Some alternative investments are subject to less regulation, increasing the risk of fraud or mismanagement.

Types of Alternative Investment Strategies

Alternative investment strategies encompass a wide range of options beyond traditional investments like stocks and bonds. Let’s delve into some of the most common types of alternative investment strategies and explore their characteristics and examples of successful implementations.

Hedge Funds

Hedge funds are pooled investment vehicles that use various strategies to generate high returns for investors. These strategies can include long/short equity, event-driven, and macroeconomic approaches. Hedge funds typically have high minimum investment requirements and are known for their flexibility in using leverage and derivatives to maximize returns.

Private Equity

Private equity involves investing directly in private companies or buying out public companies to take them private. Private equity firms raise capital from institutional investors and high-net-worth individuals to acquire ownership stakes in companies. This strategy aims to improve the performance of the acquired companies and eventually sell them for a profit.

Real Estate

Real estate investments involve purchasing properties such as residential, commercial, or industrial real estate to generate rental income or capital appreciation. Real estate investments provide diversification to a portfolio and can offer stable returns over the long term. Successful real estate investment strategies often involve thorough market research and effective property management.

Commodities

Investing in commodities such as gold, silver, oil, or agricultural products can provide a hedge against inflation and economic uncertainties. Commodities can be traded through futures contracts or exchange-traded funds (ETFs). Successful commodity investment strategies require understanding supply and demand dynamics, geopolitical factors, and global economic trends.

Venture Capital

Venture capital entails investing in early-stage companies with high growth potential in exchange for equity ownership. Venture capitalists provide capital, mentorship, and networking opportunities to help startups grow and succeed. Successful venture capital strategies involve identifying promising startups, conducting thorough due diligence, and actively supporting portfolio companies.

Factors to Consider When Choosing Alternative Investment Strategies

When it comes to choosing alternative investment strategies, investors need to carefully consider several key factors to ensure they align with their financial goals and risk tolerance. These factors play a crucial role in determining the success and suitability of the chosen strategy.

Importance of Risk Tolerance and Investment Goals

Before selecting an alternative investment strategy, investors must assess their risk tolerance level. Different alternative investments come with varying degrees of risk, and it is essential to choose a strategy that aligns with the investor’s comfort level in taking on risk. Additionally, understanding one’s investment goals is crucial in selecting the right strategy. Whether the goal is capital preservation, income generation, or capital appreciation, the chosen strategy should be in line with these objectives.

Influence of Investment Horizon

The investment horizon, or the length of time an investor plans to hold an investment, is another critical factor in choosing alternative investment strategies. Some alternative investments may require a longer investment horizon to realize their full potential, while others may be more suitable for short-term goals. Investors need to consider their time horizon and liquidity needs when selecting a strategy to ensure it aligns with their investment timeline.

Investment Advice and Strategies

When evaluating the performance of alternative investment strategies, it is crucial to consider several key factors. Understanding the risks, returns, liquidity, and correlation with traditional asset classes can help investors make informed decisions.

Role of Investment Advisor

An investment advisor plays a vital role in guiding clients on alternative investment opportunities. They help clients assess their risk tolerance, investment goals, and time horizon to recommend suitable alternative investments that align with their financial objectives.

Developing a Personalized Investment Strategy

Developing a personalized investment strategy that includes alternative investments requires a tailored approach. Investors should diversify their portfolio across different asset classes to reduce risk and enhance returns over the long term.

In conclusion, Alternative Investment Strategies offer a unique avenue for investors to diversify and thrive in the ever-evolving financial landscape. By understanding the risks and benefits, one can navigate this territory with confidence and potential for growth.

FAQ Resource

What are alternative investment strategies?

Alternative investment strategies are unconventional methods of investing that go beyond traditional stocks and bonds, such as hedge funds, private equity, or real estate.

Why should investors consider alternative investments?

Investors should consider alternative investments to diversify their portfolios and potentially achieve higher returns by exploring different asset classes.

How do risk tolerance and investment goals impact choosing alternative investment strategies?

Risk tolerance and investment goals play a crucial role in selecting the right alternative investment strategy, as they determine the level of risk one is willing to take and the desired outcomes.